A GROWING DIGITAL REMITTANCE MARKET

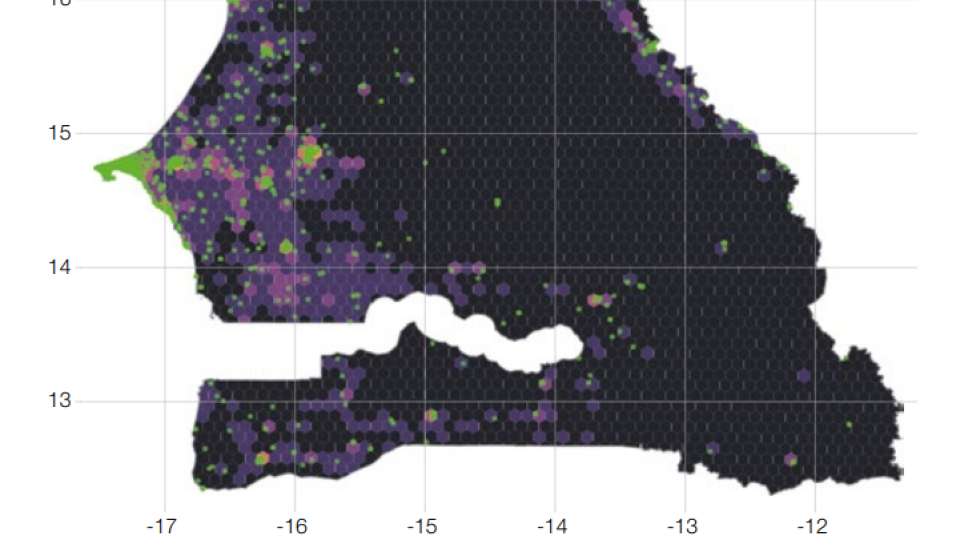

Costs of sending remittances to Senegal, particularly from the EU, are low and remittance regulations within the country are open and clear. However, the digital payment ecosystem is fragmented, and electronic money payment services are not integrated. The use of digital accounts for receiving international remittances remains limited despite the development of mobile money at a domestic level.

This research is part of a series of country diagnostics in selected African countries, in implementation of the Platform for Remittances, Investments and Migrants’ Entrepreneurship in Africa (PRIME Africa) initiative. The diagnostic report has been developed and presented to key stakeholders in the country. It details all aspects of the remittance market, including key players, stakeholders, and recommendations.