REMITTANCE MARKET UNDERGOING MOSTLY POSITIVE CHANGES

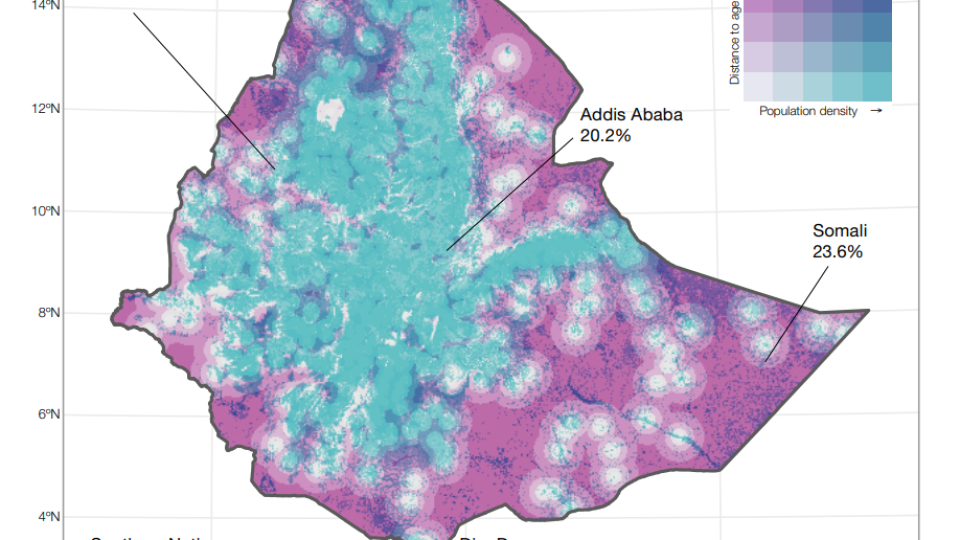

The cost of sending to Ethiopia is around the global average, but high informality threatens the attractiveness of formal remittances. Regulations are being passed to try and improve the market but these leave some stakeholders unsure of what to expect next. Generally, the regulations have been useful in opening up a market most have considered closed. For now though, remittances must be paid through the banking sector meaning the incoming mobile money players and the already strong network of MFIs can’t participate unless partnered with a bank. Much more work is needed to help improve financial inclusion and digital payments which are still in their nascent stages in the country.

This research is part of a series of country diagnostics in selected African countries, in implementation of the Platform for Remittances, Investments and Migrants’ Entrepreneurship in Africa (PRIME Africa) initiative. The diagnostic report has been developed and presented to key stakeholders in the country. It details all aspects of the remittance market, including key players, stakeholders, and recommendations.